Search Our Knowledgebase (Mac)

Reimbursements to employees can be included on paychecks for employees and are not taxed, but only included in the Net Pay.

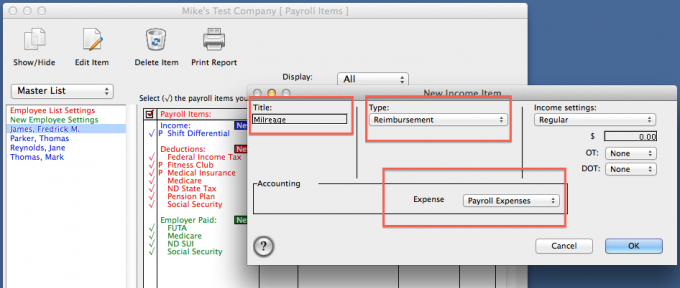

- In "Payroll Items", select an employee from the list and click on the blue "New" button across from Income.

- Enter a "Title" for the item being created, for example, Mileage.

- Form the "Type" menu, select "Reimbursement".

- By default, income items all post to the same expense account as Gross Pay in Quickbooks.

If you wish for the item to post into a different expense account in Quickbooks, select the account from the "Expense" dropdown under the "Accounting" section.

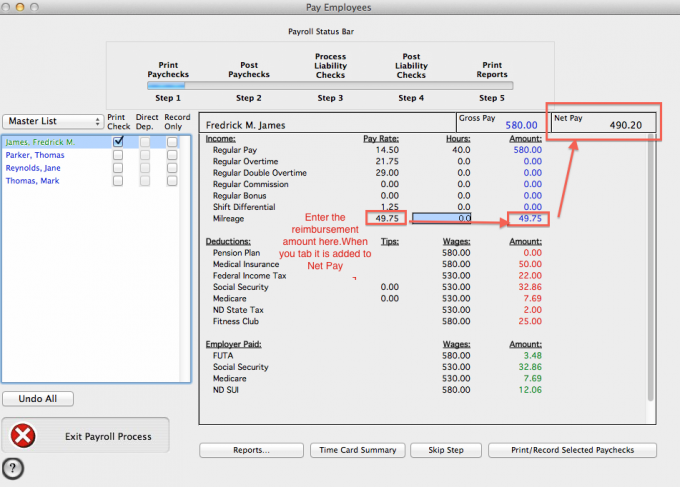

- When you process payroll, enter the amount for the "Reimbursement" under the "Pay Rate" column.

The amount entered will not be included in any taxable wages, but will only add into the Net Pay.