Search Our Knowledgebase (Mac)

Question: How do I correct "Error: State Wages are greater than State Withholding" when processing W-2's?

Answer: Follow the instructions below.

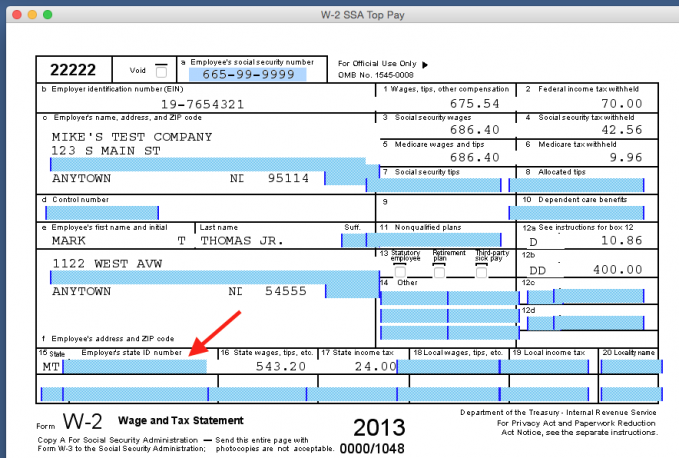

- Look at Box 15 and see if there is an Employer State ID Number.

If it is blank, it will need to be entered into the program. Once entered, it will automatically fill in when processing your forms.

- To enter your Employer State ID into the payroll program, quit out of the Form Viewer.

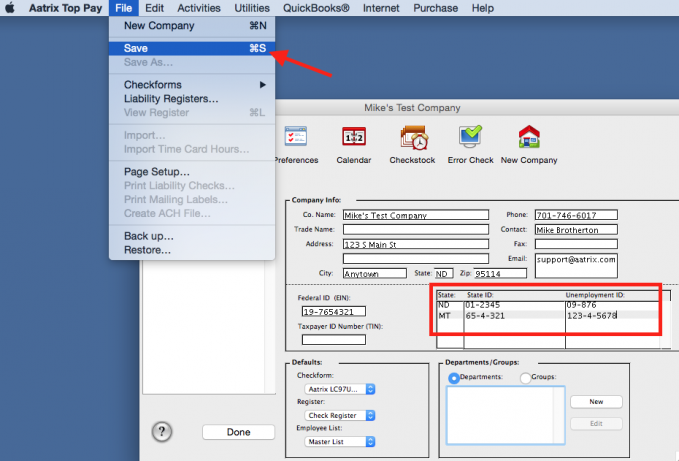

- In your payroll program, go to the Company Information screen.

- Below the Company Info, enter your State 2-letter Abbreviation using capital letters in the State column in the box to the right.

- Enter the Employer State ID for withholding in the "State ID" column.

- If you know your State Unemployment ID, you can enter it under the "Unemployment ID" column.

- Go to the "File" menu and select "Save", then click "OK".

- Reprocess your W-2's and verify that Box 15 now has the State ID entered.