Search Our Knowledgebase (Mac)

Normally pension plan deductions, such as a 401k or an IRA, are exempt from Federal and State withholding. You should double check with your accountant or plan administrator as to what taxes are exempt.

To set up the retirement plan deduction to be exempt from taxes:

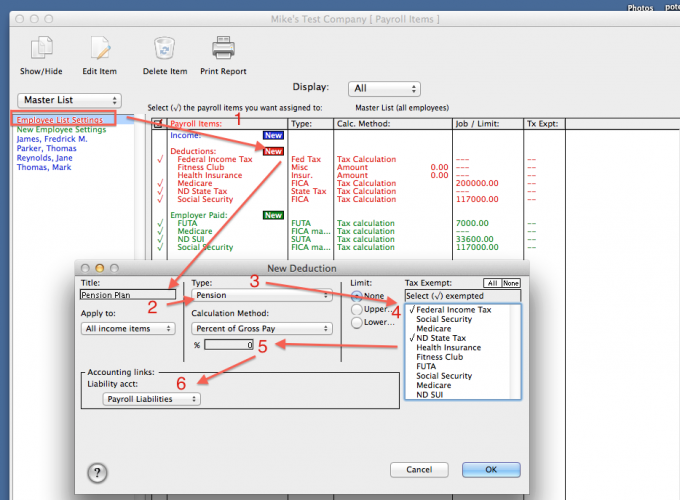

- In your payroll program go to "Payroll Items".

- Select "Employee List Settings" in red at the top of your employee listing on the left side, then click on the red "New" button to the right by Deductions.

- Enter a name for the deduction, such as Pension Plan for example.

- From the Type menu, select "Pension".

- To the right under "Tax Exempt", select the taxes exempt from the deduction. Again, Pension Plan deductions are normally exempt from the Federal and State Withholding taxes. Check with your Accountant or the plan administrator for verification of which taxes are exempt from the Pension Plan.

- From the "Calculation Method" dropdown, select the method used to calculate the amount of the deduction, normally it would be Flat Amount or Percent of Gross, leave the rate/amount box at 0.

- If you post your payroll to Quickbooks, then under the "Accounting Links" section, choose the Liaiblity Account you wish to have the deducted amount post to and click "OK" to create the deduction.

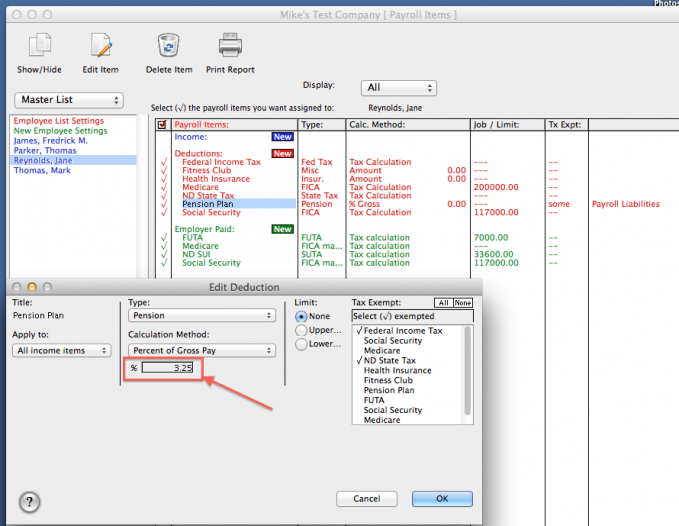

To set the pension plan item to calculate specific amounts for employees:

- Select the employee from the list and double-click on the Pension deduction.

- In the box below the "Calculation Method" dropdown menu, enter the rate if deduction is to calculate a Percent of Gross, or the amount if calculated at a Flat Amount and click "OK".

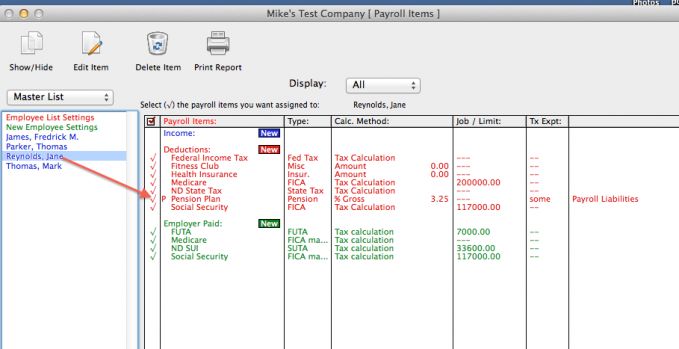

- You will notice with the employee highlighted there is now a "P" in front of the deduction indicating that the item has been personalized with a specific rate or amount for the employee.

- Repeat the above steps to personalize the deduction for employees as necessary.