Search Our Knowledgebase (Mac)

The payroll program automatically creates your Federal and State deductions for you. The program also gives you the ability to assign deductions to employees as necessary and create and assign new deductions.

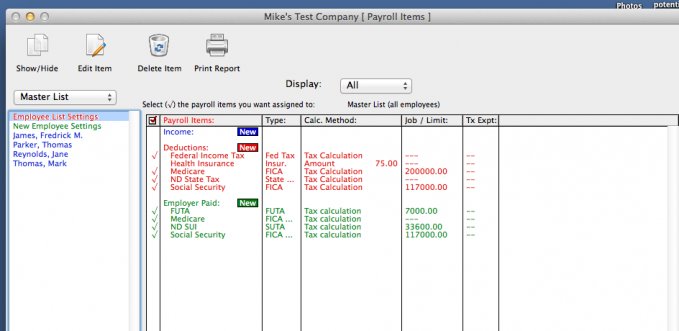

- From the main Payroll Navigator screen, click on "Payroll Items".

- On the left side of the window you will see your employees listed. At the top of the list you will see "Employee List Settings" in red and also "New Employee Settings" in green.

- Items with a checkmark in front of them with "Employee List Settings" selected indicate items that are assigned to all employees on the list.

- Items with a checkmark in front of them with "New Employee Settings" selected are automatically assigned to any new employees entered into the program.

- Items with a checkmark in front of them with an employee on the list highlighted are assigned to the employee.

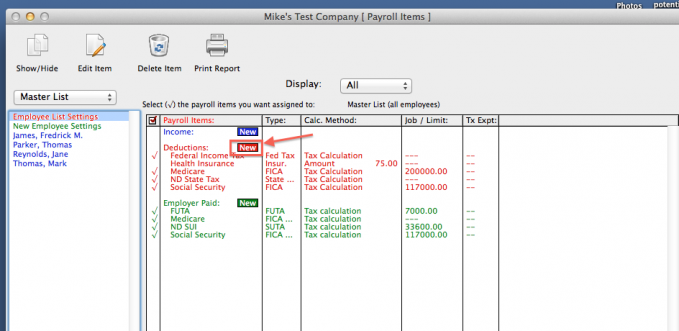

- To create a deduction that would apply to all employees on the list:

- Select "Employee List Settings" in red at the top of the listing of your employees

- Then click the red "New" button under Deductions to the right.

- To create a deduction that would apply to one employee or more, but not to all employees:

- Select the employee from the list.

- Then click the red "New" button under Deductions to the right.

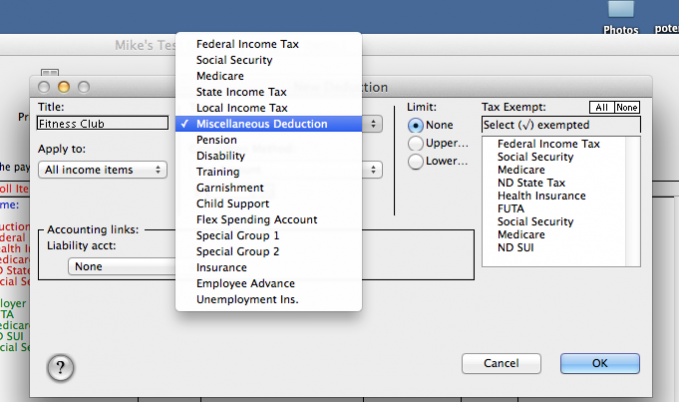

- Enter a title for the deduction that will appear in the payroll program and on checks. From the Type dropdown menu make the proper selection for the item being created.

- The Federal Income Tax, Social Security, Medicare, State Income Tax and Local Income tax types on the list are to be used for Taxes only.

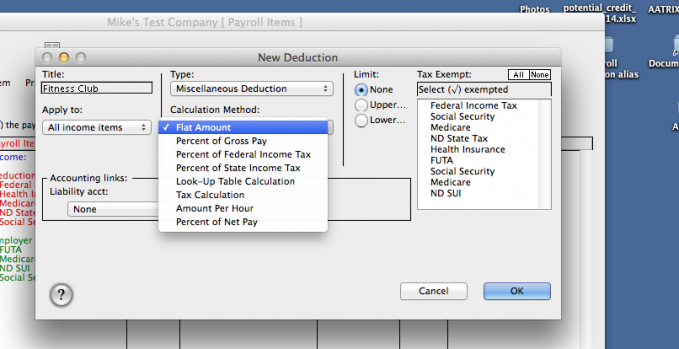

- From the "Calculation Method" dropdown select the proper method used to calculate the deduction. Normally this would be Flat Amount or Percent of Gross.

- Enter the amount/rate for the deduction.

- If you post your payroll to Quickbooks, you will need to select the Account for the item being created to post to.

For deductions this would normally be to an account set up as a type Other Current Liability in Quickbooks.

- Click "OK" to create the deduction.

- If the deduction was created with an employee highlighted and it also applies to other employees, then select them from the list and click in front of the deduction to place a checkmark there indicating that it has been assigned to the employee.