Search Our Knowledgebase (Mac)

Medical deductions are normally exempt from the Federal and State Withholding and the Medicare and Social Security Taxes.

For clarification as to what taxes are exempt from medical items consult with the plan administrator or your Accountant.

To set up medical items to be properly exempted from taxes:

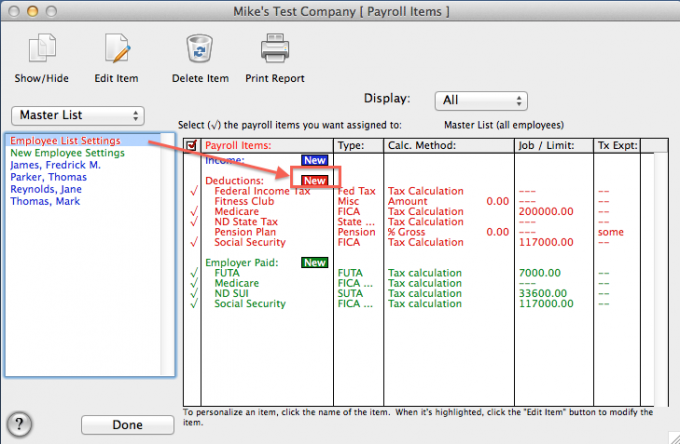

- In Payroll Items, click on the red "New" button across from Deductions.

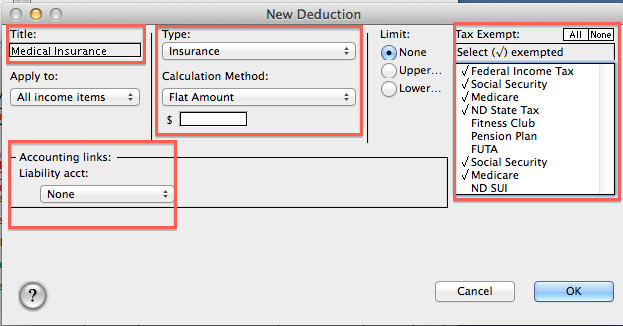

- In the "Title" box, enter a title for the deduction that will appear on checks and in the program.

- From the "Type" dropdown menu, choose "Insurance".

- Select the proper "Calculation Method". This would more than likely be Flat Amount for an Insurance deduction. Leave the amount at $0.

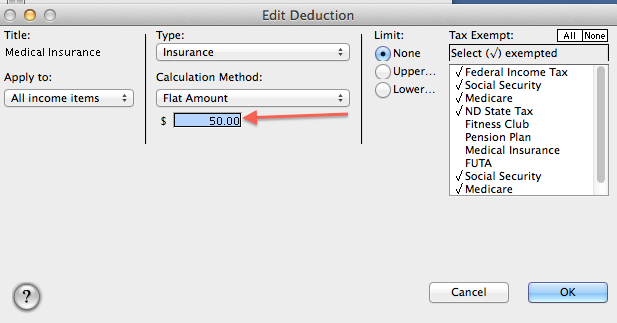

- To the right under "Tax Exempt", select the taxes that the item is exempt from.

If the Medicare and Social Security are exempted be sure to select the deductions and the company portion of the taxes.

- If you post your payroll to your Quickbooks program under the "Accounting Links" section, select the account to track the liability amount in and click "OK" to create the deduction.

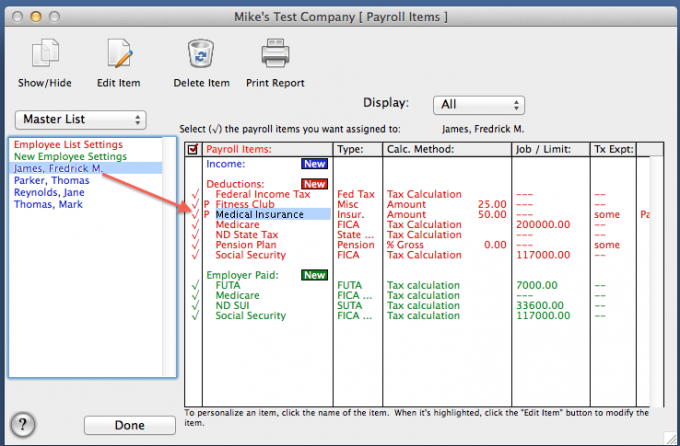

- Select an employee from the list that would be subject to the Medical Insurance Deduction.

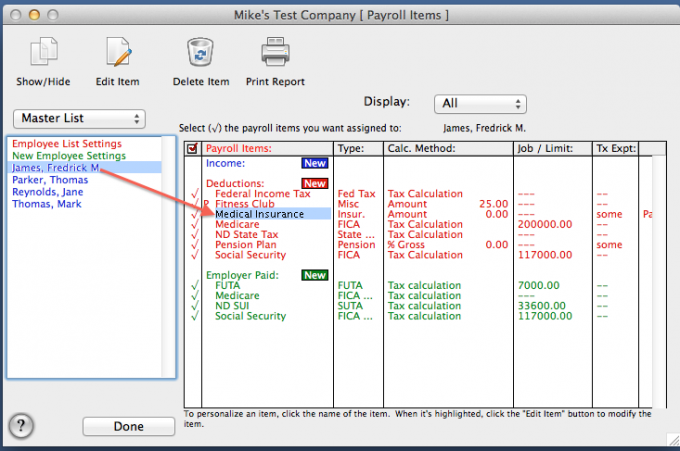

- Double-click on the Medical Insurance deduction to bring up the "Edit Deduction" window.

- In the "$" box below the "Calculation Method" enter the amount to be deducted for the employee highlighted each payday and click "OK".

- The "P" that appears in front of the deduction with the employee selected on the list indicates that the Medical Deduction has been personalized to calculate a specific amount for the employee.

- Select any other employees subject to the Medical Insurance deduction and repeat the steps to personalize for each.