Search Our Knowledgebase (Windows; U.S.)

- Open the accounting software and navigate to the Form Selector.

- Select to view the history filings / Form History.

Different accounting softwares have different buttons or ways to access history from the Form Selector. It may be a button, a drop down, or a radio button, and may have different labels depending on the software vendor. It may be called History, View History, Existing Reports, or Saved Reports.

For assistance getting to the History, contact your payroll software.

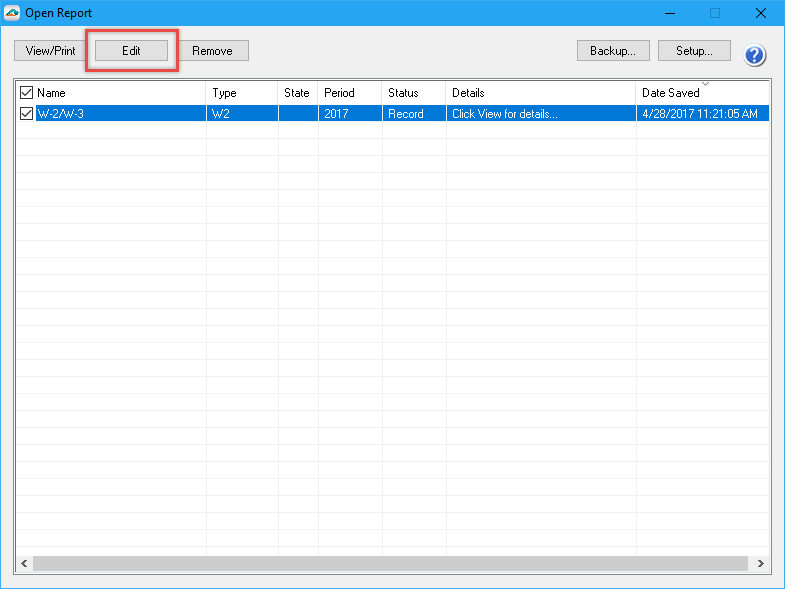

- Next, it will display a window titled Open Report with a listing of the previous filings. Select the W-2/1099 Filing and click Edit.

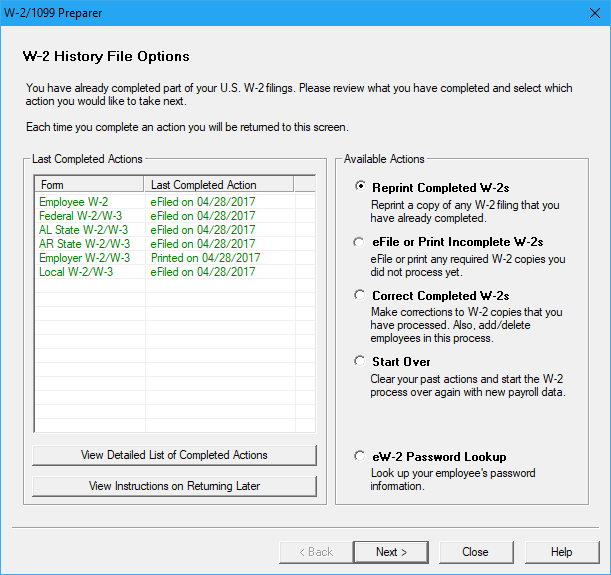

- The next screen is the History File Option screen. Choose the radio button beside the Reprint option and then click Next.

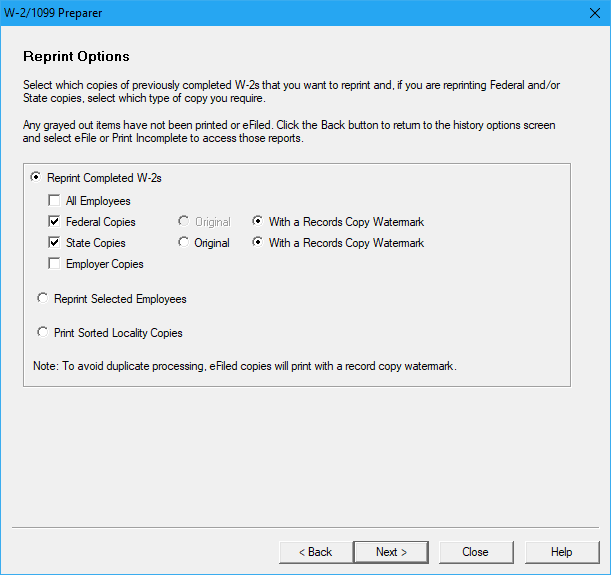

- If you have processed more than one W-2 type (i.e. Federal and State), you will be asked which type to re-print. Once you've selected the type to reprint, click Next.

- If you have selected to re-print employee copies, you will be asked if you want to reprint select employees or all employees. By clicking the Select Employee option, you will be taken to a list of employees to re-print.

- Then the Forms Viewer will display allowing form copies to be printed.

Note: Keep in mind that if you have previously eFiled the Federal copy, it will print with a record copy watermark to avoid duplicate processing. State eFiled copies do not print with a record watermark, so they can be used to file with the Local W-2s.

Additional Information: