Search Our Knowledgebase (Windows; U.S.)

Guidance on Reporting Qualified Sick Leave Wages and Qualified Family Leave Wages Paid Pursuant to the Families First Coronavirus Response Act in accordance with the IRS Notice 2020-54

In addition to including qualified sick and family leave wages in the amount of wages paid to the employee reported in Boxes 1, 3 (up to the social security wage base), and 5 of Form W-2, employers must report to the employee the wages that were paid, with each amount separately reported either in Box 14 of Form W-2 or on a separate statement.

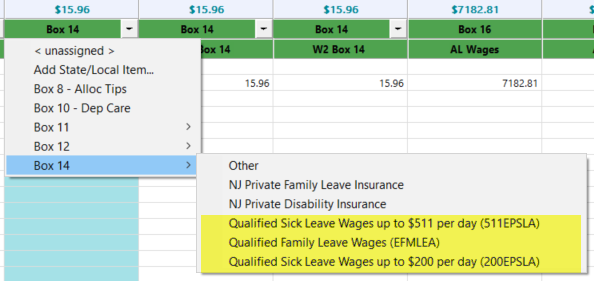

Aatrix has added 3 separate Box 14 items to follow these guidelines and they are described below:

- 511EPSLA - Qualified Sick Leave Wages up to $511 per day

- 200EPSLA - Qualified Sick Leave Wages up to $200 per day

- EFMLEA - Qualified Family Leave Wages