Search Our Knowledgebase (Mac)

Most of the W-2 information will automatically fill in for you, such as the Federal and State taxes.

There are items reported on the W-2's that are not automatically set up. Items to be reported that would need to be set up and reported on the W-2's would include but not be limited to:

- Pension Plans

- Medical Insurance

- Cafeteria Plan Items

For further guidance on what items should be reported on the W-2's contact your Accountant or the plan administrator.

To add the items to the W-2 in your payroll program:

- Go to the "Reports Plus" section and choose the "20XX W-2" from the list.

- Set the Report Period and then click on "Preview Report".

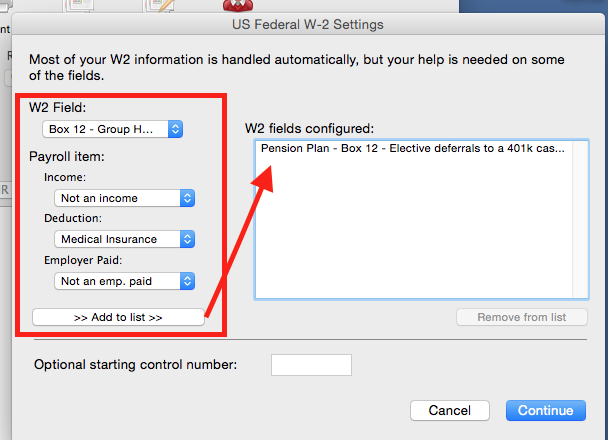

- In the "US Federal W-2 Settings" box, from the "W-2 Field" dropdown menu, select the proper entry for the item being reported.

If you need guidance as to what to select contact the plan administrator or your accountant.

- In the "Payroll Items" section, select the item to be reported. (For example, a Pension Deduction.)

- Click the "Add to List" and it will appear in the "W-2 Fields Configured" and will pull in for your employees on the W-2.

- Once all items have been added click "Continue".