941 Changes For The Third Quarter 2020

Oct 12, 2020

941 Changes For The Third Quarter 2020

Update on IRS Form 941 Changes Effective Immediately

Aatrix continues to monitor the changes to state and fed payroll reports and payments due to new legislation or executive orders. Aatrix published a description of the changes made for second quarter filings in July which included the information below.

The IRS has published a revised Form 941 to be used for the second quarter filings in 2020. The new 941 form includes the changes made by the Families First Coronavirus Response Act and the Coronavirus Aid, Relief, and Economic Security Act that added various types of payroll tax relief.

Specifically, the new IRS 941 form adds lines to account for:

- Credit for Qualified Sick and Family Leave Wages;

- Employee Retention Credit; and

- Deferred Amount of the Employer Share of Social Security Tax.

Details of Changes For Third Quarter 941 Filing

The Changes to the 941 have been made to accommodate the executive order allowing businesses to defer both employer and employee payroll taxes.

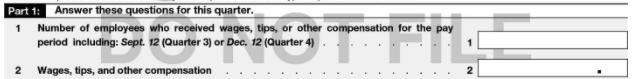

Line 1

Line 1 changes the dates that the form is to be used to include just the third and fourth quarter.

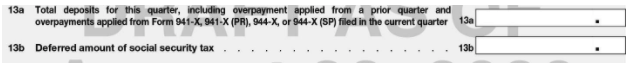

Line 13b

Line 13b will be used to report the total amount of deferred social security tax. Both employer and employee.

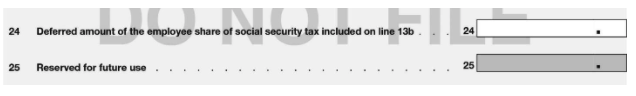

Lines 24 and 25

Line 24 will be used to report the employee share of the social security tax deferred.

Aatrix has released these updates on 10/1/20 so your 941 has been fully updated for 3rd quarter.