What Is The New IRS 7200 Tax Form?

May 18, 2020

What Is The New IRS 7200 Tax Form?

The IRS issued a new form for employers to use to obtain advance payments of three tax credits that were created to help businesses cope with the coronavirus pandemic.

- Qualified sick leave

- Family leave wages

- Employee retention credit

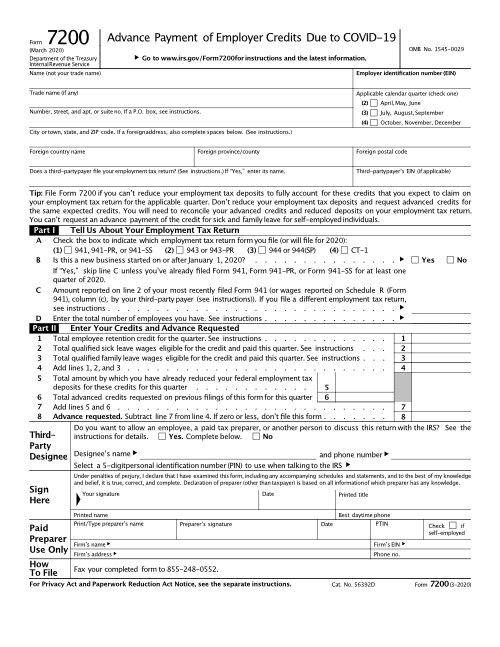

Employers may file new Form 7200, Advance Payment of Employer Credits Due to COVID-19, to obtain advances of employment taxes that are refundable as a result of the new tax credits.

When Is The Form 7200 Tax Form Filed?

Employers can file the form for advance credits anticipated for a quarter at any time before the end of the month following the quarter in which the employer paid the qualified wages. Employers are permitted to file Form 7200 several times during each quarter.

Form 7200 is used to request an advance payment of the tax credits for qualified Sick Leave wages, Family Leave wages, and the Employee Retention credit that you will claim on the following federal forms.

- Form 941, 941-PR, 941-SS

- Form 943, 943-PR

- Form 944, 944 (SP)

- Form CT-1

Employers should not file Form 7200 after they file any of these forms.

What Information Is Included On Form 7200?

In Part I of the Form 7200 there are two boxes to fill out.

- Box 1– Basic business information (business name, address, third party payer details, EIN)

- Box 2– Choose the calendar quarter for which you are filing this form. This indicates when the wages were paid.

Part II

Indicate which employment tax form filed and indicate whether the filer is a new business. The amount reported on the most recent 941. Report the number of employees that you have.

Part III

Details of the requested credit.

Line 1– Total employee retention credit for the quarter

Line 2– Total qualified sick leave wages eligible for the credit and paid this quarter

Line 3- Total qualified family leave wages eligible for credit paid this quarter

Line 4– The sum of line 1, 2, and 3

Line 5- Total amount by which you have already reduced your federal employment tax deposits for the quarter.

Line 6– Total advanced credits requested on previous filings of Form 7200 for the quarter.

Line 7– The sum of lines 5 and 6.

Line 8- Your Advance Payment Request

This amount is calculated by subtracting line 7 from line 4.

If the amount is less than zero, the filer is not eligible to file the IRS Form 7200.

Aatrix is the leading payroll tax reports, payments, and eFiling service provider for over 300,000 businesses in the US and Canada. Aatrix supports the Form 7200. Questions? Go to efile.aatrix.com