Aatrix Announces Initiatives To Meet Anticipated Growth in 2012

Feb 22, 2012

Aatrix Software, Inc., a leading W-2 eFile provider announced initiatives to meet needs driven by anticipated growth for 2012. Initiatives include increased staff, capital investment in infrastructure, and implementation of new technologies.

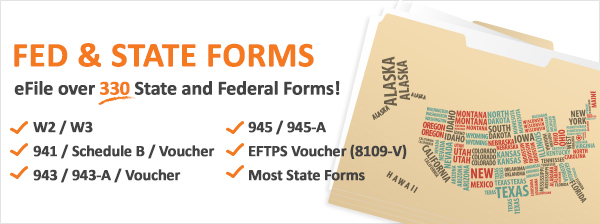

Aatrix supports all state and federal Payroll Reporting Forms including US territories as well as Canadian reports. Aatrix provides plain paper printing, eFiling, and compliance services for State and Federal W2s, 1099s, Unemployment, New Hire, and Withholding Reports and payments currently available to more than 200,000 businesses as a fully integrated OEM product within their payroll software. Aatrix is currently partnered with more than two dozen payroll solutions.

eFiling continues to grow

State and Federal eFiling requirements are mandating more businesses to eFile payroll reports and payments every year.

More than a dozen states either lowered the threshold for employee count requirements or outright mandated that businesses eFile wage withholding, unemployment, and new hire reports.

The federal government requires virtually all employers to make withholding payments electronically.

The efficiencies provided government agencies by requiring eFiling will continue the trend towards requiring business to file reports and payments electronically.

Electronic tax administration is the foundation for a modernized IRS that provides secure, convenient, timely and accurate services to taxpayers, and to the tax professionals and IRS employees who serve them. (IRSOB-E report 2010 page 9)

The full vision for a modern ETA environment goes beyond just e-filing and seeks to make electronic interactions among taxpayers, tax practitioners, and the IRS the norm. These electronic interactions include the entire range of pre-filing, filing, and post-filing tax activities which taxpayers and their representatives may engage in with the IRS, including the ability to resolve taxpayer account issues over the Internet. (IRSOB-E report 2010 page 9)

The Board emphasizes the need to substantially increase the e-file rate, particularly among businesses filing employment tax returns, because it is crucial to the IRS to achieve the strategic 80 percent electronic filing goal. (IRSOB-E report 2010 page 39)

It is clear that the movement towards electronic filing is more than a trend. It is inevitable that virtually all reporting to taxing authorities will be electronic.

Businesses are moving to efiling for solid reasons.

• The reporting of tax liabilities to multiple state and federal agencies is one of the most onerous and scary requirements of having employees.

• No matter what size the company, compliance to eFiling requirements, ever-changing forms, and meeting new guidelines legislated into existence during the year is difficult and opens customers to significant fines and penalties for non-compliance.

• Large companies may make deposits and file reports several times a week. Hundreds of filings in multiple states each year. Automating this process provides significant savings.

Why Aatrix has a growing market share

Simply put it has three dramatic advantages over the use of the agency sites: Simplicity, accuracy, and efficiency.

• One account to eFile and track all reports and payments

• eFiling is completed within the payroll solution without additional exports, typing, and logging into multiple sites

• Reports are completed using the data within the payroll solution

• Reports are filled in automatically with no need for manually transcribing

• Reports are time-stamped and saved on the customers machine and accessible anytime for review or audit

• Aatrix complies with all legislation, eFile requirements, and form changes

• The interface is very simple. Choose a form, review it onscreen, and click eFile.

Aatrix Initiatives

Aatrix increases staff

Aatrix is adding staff to virtually every department. Recent hires have been made in Support, Sales, and development. In addition to seasonal hire for tax season, Aatrix has nearly doubled its support staff. The development department continues to grow as well. Aatrix has added programmers, script writers, and IT professionals in order to move forward with product enhancements, processing improvements, and implementation of new technologies.

Aatrix beefs up their infrastructure

Aatrix has invested a significant portion of their profit from 2011 and has budgeted even more for 2012 for improvements and expansion of their infrastructure.

These include:

• Improved hardware including servers, workstation, IT management, and telephony

• Increased data handling capacity via additional equipment and software enhancements

• Improved redundancy and overflow capacity by adding offsite as well as onsite equipment and processing power

Improved technologies

Aatrix has moved a significant of their routine processing, data management, and backup efforts utilizing the Cloud. This move has dramatically increased efficiencies and enhanced their customers experience by reducing processing time during the eFiling preparation, error checking, and delivery.

The Future

Aatrix has a history of being ahead of the curve and willing to invest a significant amount of their profits to maintain the competitive advantages they deliver to their partners. With unprecedented continued growth in the face of tough economic times Aatrix shows no sign of changing this winning philosophy.