Search Our Knowledgebase (Windows; U.S.)

When using Aatrix' eFile solution for the W-2 process, we perform basic error checking in the Preparer. Aatrix does this to ensure that the filing has the correct W-2 information and to avoid rejections by federal and state agencies. Below are some of the basic error checks that will be performed.

- Error Checking in the W-2 Employee Preparer

The W-2 Employee Preparer performs several data verification steps to ensure W-2 information is correct and to avoid rejections by federal and state agencies.

- Verifying Employee Information

Upon entering the Preparer, the first step for all users is to verify employees' names. This requires you to pay special attention to employee information to avoid sending employee copies out with incorrect information (i.e. name change), and then being required to send a corrected W-2 copy to those employees.

Although we are asking the user to verify employees' names, there are several verifications being processed on all employee information.

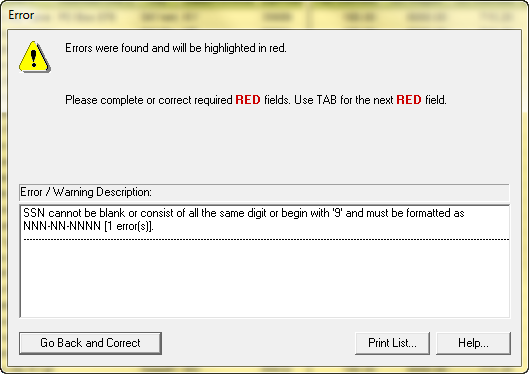

- Invalid Social Security Numbers

If an error is detected on any of the employees' social security numbers, the following error dialog will appear:

"X employee(s) have incorrect social security numbers. Incorrect social security numbers on your W-2 forms will be rejected by the SSA.

If the number begins with 9, it is likely an Individual Taxpayer Identification Number (ITIN). An ITIN cannot be used for the W-2."

These errors must be corrected, or delete the employee(s) from the filing and process them through alternative means;they cannot be processed through the W-2 Preparer. All fields with identified errors will be highlighted in red.

- Duplicate Social Security Numbers

Employees with a duplicate social security number cannot be processed. If any employees have the same social security number, the following error dialog will appear:

"Social security number XXX-XXX-XXX is listed X times in the preparer. You are unable to process more than one employee with the same social security number in the W-2 Preparer. All cells with identified errors will be highlighted in red."

You will then have option to either manually go back and make the changes to the employees with the duplicate social security number or combine them automatically.

Note: You can only automatically combine employees with duplicate social security numbers if they have matching employee information (name, address, ect.).

- Employee Name and Address Verification

If an error is detected on any employee's names or addresses, an error message will state:

"The following errors occurred with your employee information. All cells with identified errors will be highlighted in red; you must correct these errors before

Note: This will also check the address for any foreign employees. Specifically for Canadian employees, the Postal Code format will be checked along with the Province code.

- Employee Wage Amounts

When the W-2 Employee Preparer is verifying employee wage amounts, there are two types of errors that can occur:

1. Fatal Errors. These types of errors are considered a cause of rejection by the Social Security Administration and you are not able to bypass the W-2 employee Preparer without correcting them.

2. Non-Fatal Errors (Warnings). These types of errors are considered warnings and are not a cause of rejection by the Social Security Administration but are not common in W-2 processing. We suggest you look over these errors; however, you are able to continue in the W-2 employee Preparer without correcting these errors.

- Fatal Employee Wage Errors

If a fatal error is detected on any of the employee's wage details, an error message will state:

"The following errors occurred with your employee wage details. All cells with identified errors will be highlighted in red; you must correct these errors before continuing”

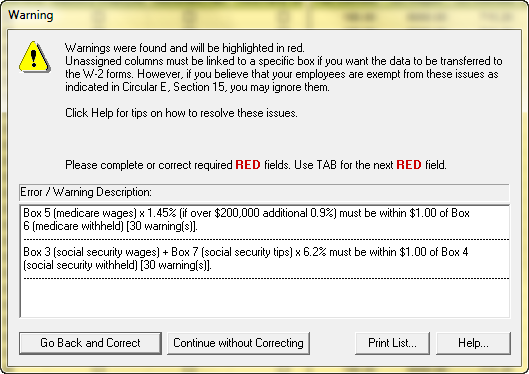

- Non-Fatal Employee Errors

If a non-fatal error is detected on any of the employee's wage details, an error message will state:

"The following problems occurred with your employee wage details. All cells with identified issues will be highlighted in red.”

However, if you believe that the employees are exempt from these issues as indicated in Circular E, Section 15, you may ignore this message and choose to continue without correcting.

- Verify Linked Boxes

Not all data required for W-2 processing comes through to the employee preparer as defined to certain boxes. If the columns that are undefined come through and dollar amounts are detected the following message will appear:

"The following warnings occurred with your employee wage detail: Undefined columns must be defined as Box 8-14 if you want the data to be transferred to the W-2 forms. There are one or more undefined columns with dollar amounts in the Preparer”

Any unassigned columns will not display on the W-2 forms.

Additional Information: