Search Our Knowledgebase (Mac)

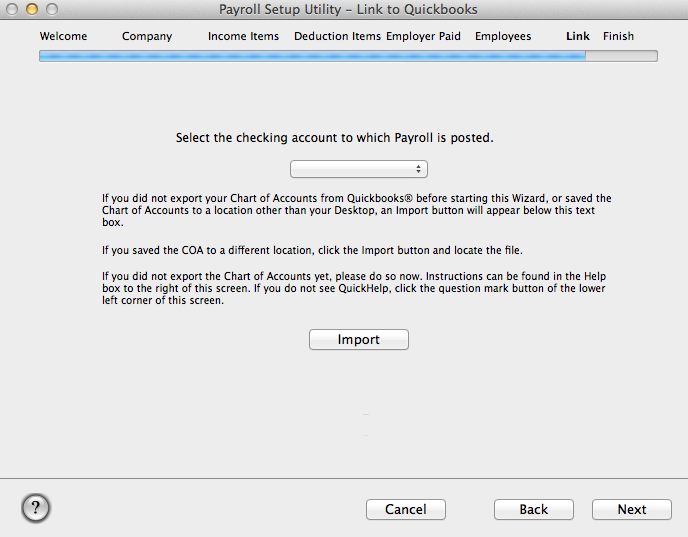

If you're posting your payroll to Quickbooks, you will need to export your Chart of Accounts from Quickbooks program first and saved on the desktop so they can be imported into the payroll program and the proper links for payroll set up.

- With the program already installed on the computer, open your Hard Drive, go into your Applications folder and into your Aatrix Top Pay/Ultimate/Paycheck program folder and double click on the program icon to open.

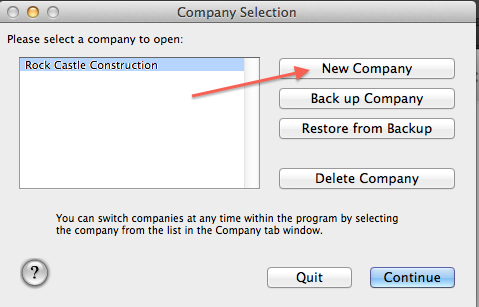

- At the Company Selection window, click on the "New Company" button on the right side.

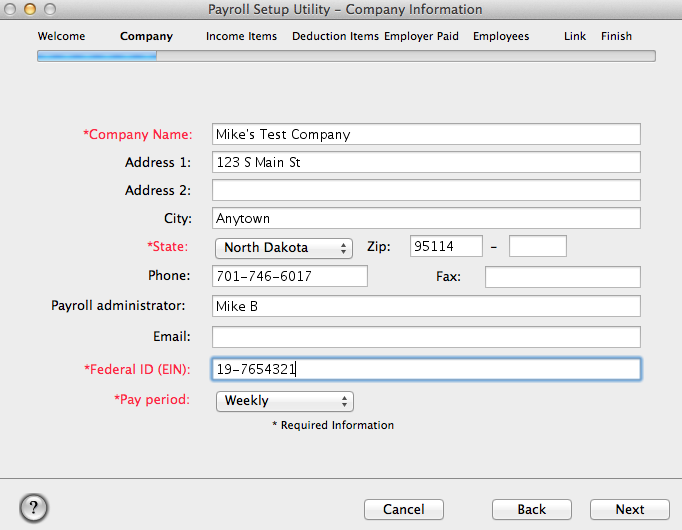

- Click "Next" in the window that opens to go to the Company Information setup. Items marked in red are required. Once you have the information entered click "Next".

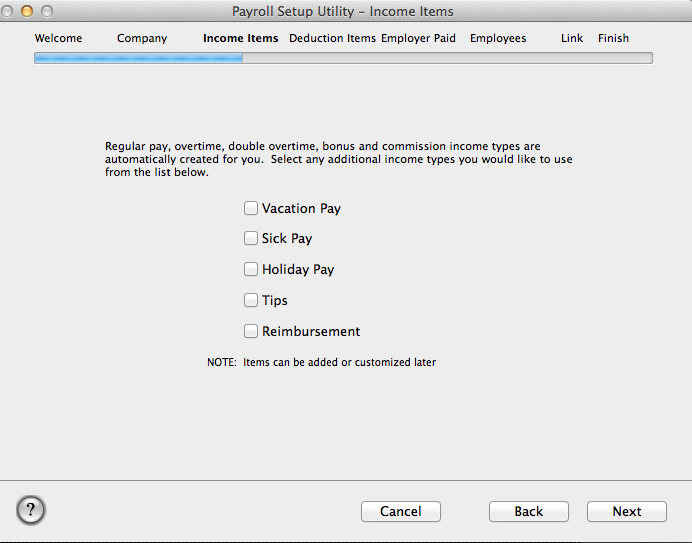

- The basic income items, Regular Pay, Overtime Pay, Double Overtime Pay, Commission and Bonus will already be created for you.

- In the Income Items setup, choose the additional income items you use to pay employees with, for example Vacation Pay and Holiday Pay, and they will be created for you.

- When you have finished click "Next".

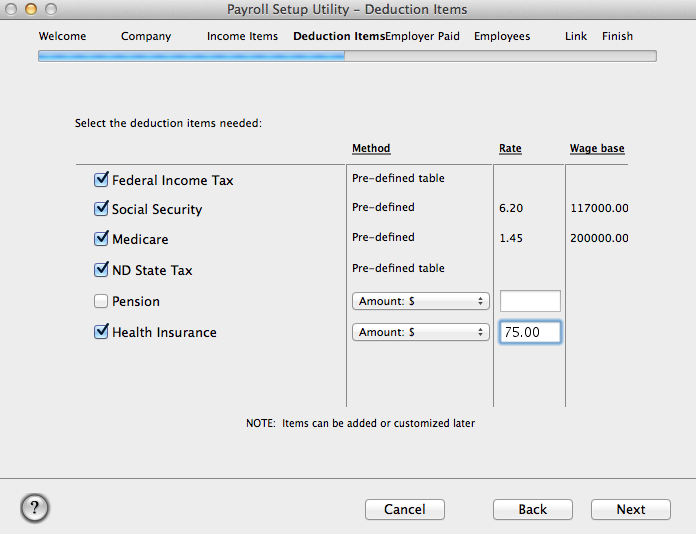

- In the Deduction Items setup, the Federal Withholding, Social Security, Medicare and your State Withholding have already been created and selected for you.

If your state does not have a Withholding tax you can uncheck it.

- If you offer a Pension such as a 401K, or Health Insurance you can choose them here and then select whether it is a Flat Amount or Percentage and in the box to the left enter the amount/rate to be deducted each payday.

Click "Next" to continue with the setup.

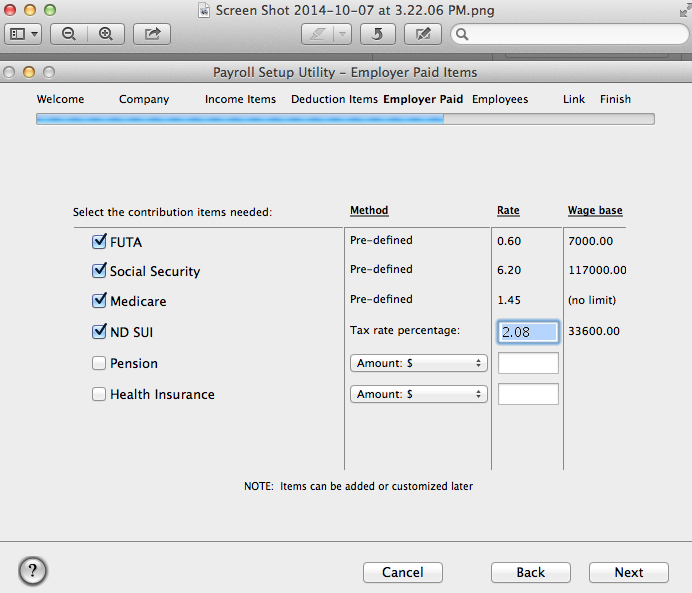

- In the Employer Paid setup are the items that are paid by the company.

Notice that the FUTA (Federal Unemployment), Social Security, Medicare and your State SUI (State Unemployment Insurance) are already created and selected for you.

- Enter your State Unemployment Rate in the box if you know it.

If you offer the other items listed and the company pays for a portion you can select them and enter the amount/rate.

Click "Next" to continue with the setup.

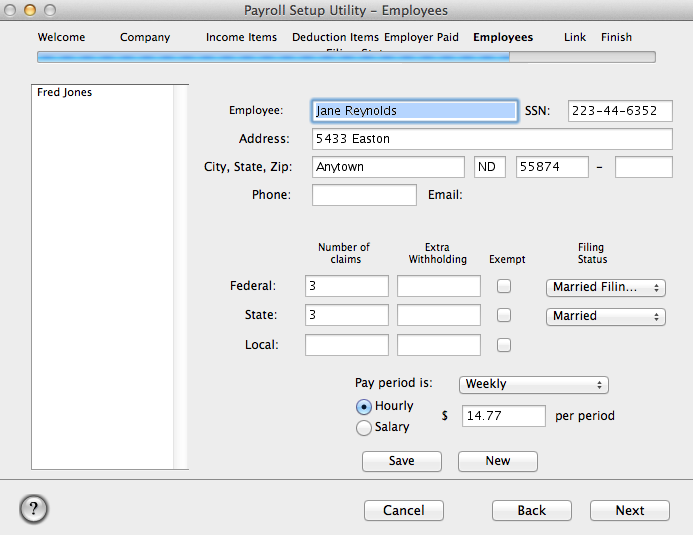

- The next step of the setup process is to enter your employees.

In the Employees setup, click the "New" button and enter the information for an employee.

Once you have the information entered click the "Save" button to have the employee added to the list on the left.

- Click the "New" button and enter the remaining employees in the same fashion.

When all employees have been entered click the "Next" button.

- If you're posting your payroll to Quickbooks, you should already have your Chart of Accounts exported and saved on the desktop.

- In the Link setup click the "Import" button.

In the window that opens navigate to your Chart of Accounts list you exported from Quickbooks and select it then click "Open" to bring the account list into the program.

- From the dropdown menu above, select the checking account to be used for payroll checks.

- Click "Finish" to have the company created and listed for you at the Company Selections screen.